College football is back.

And so are their student-athletes — who will be walking into an unprecedented new reality.

Colleges are about to pay student-athletes $20.5 million annually while sitting on hundreds of acres of underutilized real estate—making them the most overlooked infrastructure plays in American sports.

Think of universities less as educational institutions and more as unleveraged utility companies that happen to run football teams. Major universities control thousands of acres in prime metropolitan areas, often worth hundreds of millions, with utilization rates that would horrify any commercial real estate operator. While some family offices debate crypto allocations, the smartest capital is quietly positioning itself to monetize the land arbitrage hiding in plain sight on college campuses.

The new athlete compensation requirements create immediate capital needs that traditional university funding cannot efficiently address—but they also reveal why sophisticated operators are launching infrastructure funds specifically targeting collegiate real estate opportunities.

⸻

Market Intelligence: The Capital Structure Hidden Beneath Stadium Parking Lots

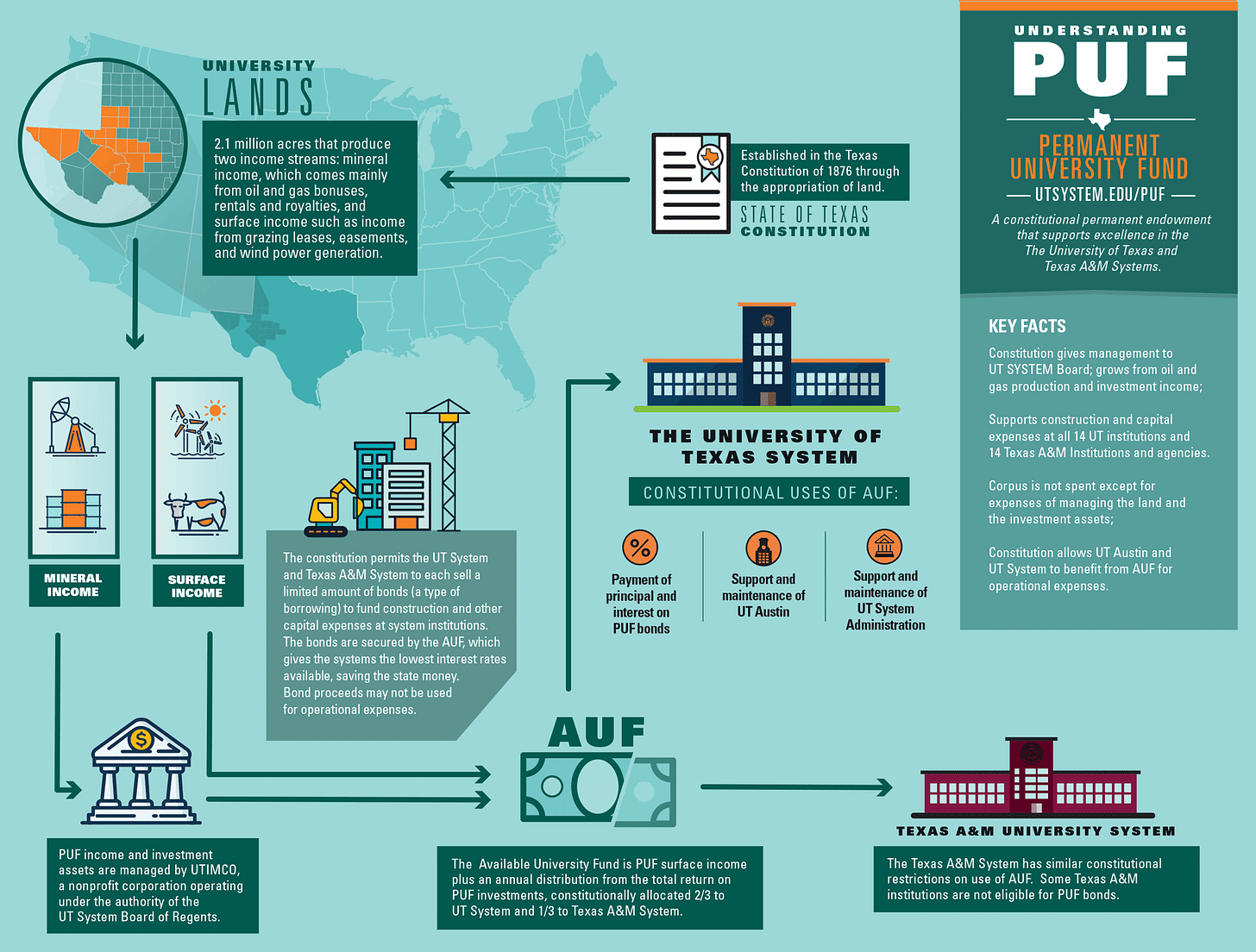

The University of Texas Moody Center deal structure reveals the operational mechanics others are missing: a 35-year services agreement where the developer operates the building without paying rent, funded through private debt and equity with operational risk transferred entirely to Oak View Group.

This isn’t stadium financing—it’s infrastructure-as-a-service applied to collegiate real estate. OVG takes 100% of non-university event revenue for 35 years in exchange for a $338 million capital investment, effectively creating a ground lease structure that generates immediate capital while preserving long-term university ownership.

The numbers illuminate why sophisticated capital is moving now. College stadium construction spending is estimated to exceed $3 billion in 2025 based on major announced projects including South Carolina’s $350 million Williams-Brice Stadium renovation, Kansas’s $360 million Gateway District Phase 2, Tennessee’s $337 million stadium upgrades, and dozens of other multi-hundred-million-dollar projects across Power Five conferences—but that’s the visible portion. The invisible opportunity lies in the 200+ acres surrounding each major stadium, most of which operates at sub-20% utilization rates outside game days.

Power conference schools generate an average of $100 million in annual revenue, with the new athlete compensation requirements consuming 22% of that pool. This creates immediate cash flow pressure that traditional university funding mechanisms—endowments yielding 3-5% annually—cannot efficiently address.

Here’s the arbitrage: Universities need infrastructure capital with 10+ year payback periods, while infrastructure investors need stable, recession-resistant cash flows with municipal bond-equivalent risk profiles. College campuses offer both, wrapped in 501(c)(3) tax advantages that nobody talks about.

⸻

Investment Thesis Development: Real Estate Derivatives Disguised as Stadium Bonds

The conventional wisdom focuses on teams and media rights. The contrarian thesis focuses on physical infrastructure utilization rates.

Ground leasing allows institutions to maintain consent rights over construction aesthetics while generating substantial cash flow without selling cherished campus assets. This structure solves the political problem—no university wants to “sell the campus”—while unlocking the economic value through long-term lease monetization.

Consider the revenue layering potential: A 100-acre campus development zone can generate income through (1) ground lease payments, (2) premium event hospitality, (3) mixed-use commercial leasing, (4) parking monetization, and (5) naming/sponsorship rights. Arizona State’s Novus Innovation Corridor demonstrates the model: 350 acres generating $58.2 million in annual economic output, with property rate improvements attracting additional commercial tenants.

The timing advantage is structural. Schools can share up to $20.5 million with athletes starting in 2025, with the cap increasing 4% annually over 10 years. This creates predictable, escalating capital needs that traditional funding sources cannot efficiently meet. Meanwhile, athletic departments are losing booster support as donor funds redirect to NIL collectives rather than direct institutional giving, creating a funding gap that infrastructure monetization can fill.

The risk profile resembles municipal bonds more than venture capital: University land appreciates with metro area growth, fan engagement provides recession resilience, and educational mission provides regulatory protection. The returns, however, target private equity multiples through operational leverage.

⸻

Thanks for reading Magnolia Hill Partners! Subscribe for free to receive new posts and support my work.

⸻

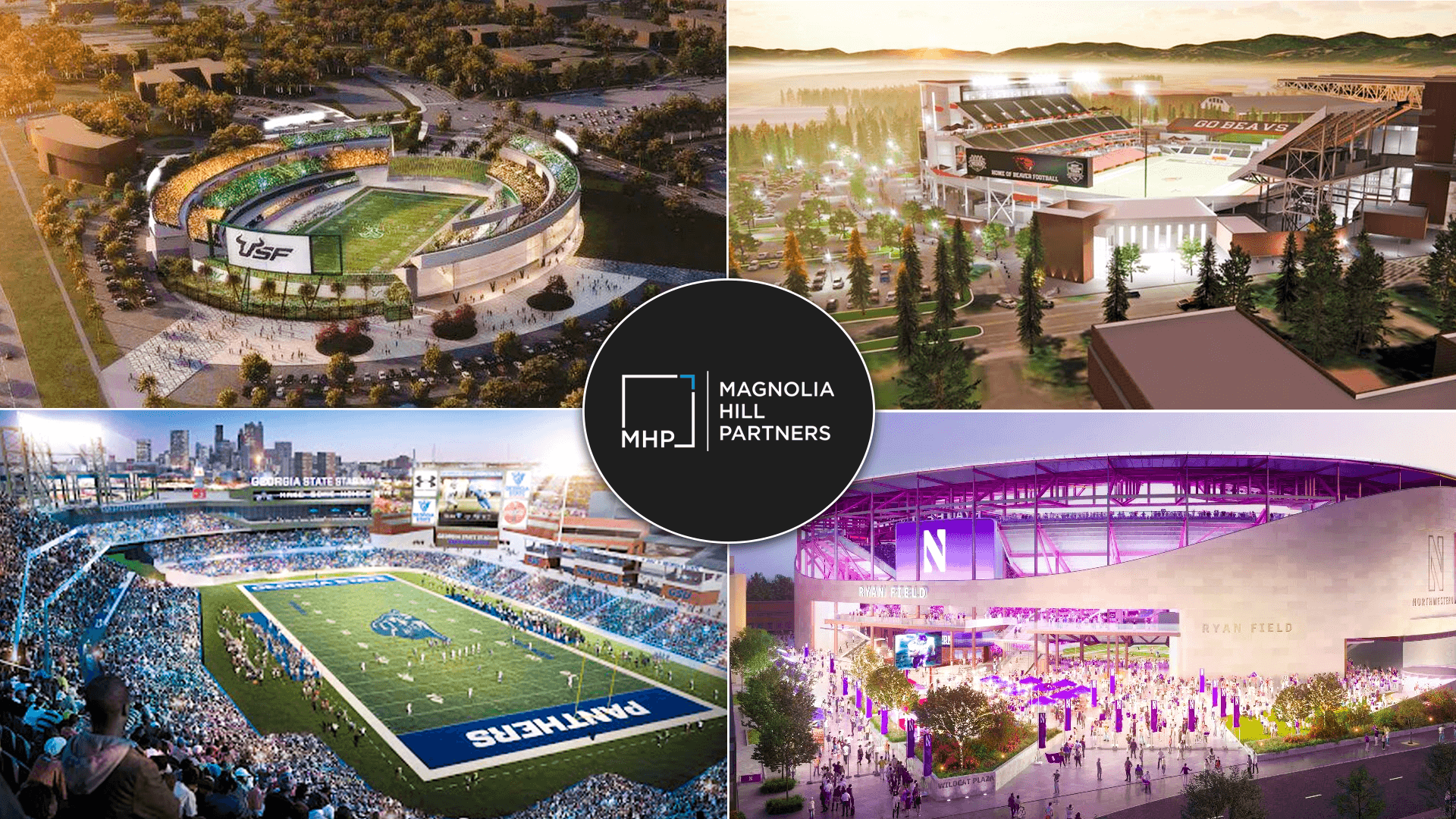

Case Study: Elevate’s $500 Million Infrastructure Monetization Machine

Elevate’s Collegiate Investment Initiative, backed by Velocity Capital Management and the $60 billion Texas Permanent School Fund, represents the first institutional-scale attempt to systematically monetize collegiate infrastructure.

The structure reveals sophisticated understanding of university constraints. Rather than equity investments in athletic departments—which would trigger complex regulatory and tax complications—Elevate provides debt capital for revenue-generating projects including venue upgrades, premium seating expansions, and multimedia rights development.

The operational mechanics matter: Elevate combines capital deployment with strategic consulting, leveraging its network of architects, designers, and operational specialists. This isn’t passive lending—it’s infrastructure development with embedded operational expertise that universities cannot efficiently source internally.

College stadium projects aren’t expected to slow down in 2026, with schools utilizing new capital to create premium experience spaces monetized at higher price points. The strategy focuses on fan experience enhancement that generates both immediate revenue and long-term asset value appreciation.

The clearing mechanism demonstrates institutional validation. While initial reports suggested Penn State and UCLA as early participants, both institutions publicly denied private equity involvement, highlighting the political sensitivity that requires careful deal structuring. Successful implementation requires navigating university governance, state oversight, and public perception—operational complexities that favor experienced operators over financial buyers.

The model scales through conference relationships and operational leverage. Elevate maintains comprehensive operating agreements with 60+ university clients, providing deal flow visibility and implementation efficiency that standalone investors cannot replicate.

⸻

What This Means for You: Infrastructure Arbitrage with Educational Mission Wrapper

Family offices should reframe college sports infrastructure as utilities-plus-growth plays. The base case generates municipal bond-equivalent returns through ground lease income and operational cash flows. The upside case captures real estate appreciation and operational leverage as universities professionalize their commercial operations.

Two actionable strategies emerge:

-

Direct Infrastructure Partnership: Partner with universities on mixed-use developments adjacent to athletic facilities. Structure as ground leases with development rights, maintaining university land ownership while capturing long-term appreciation and operational cash flows. Target universities in growing metropolitan areas with underutilized acreage and strong athletic programs that generate consistent foot traffic.

-

Platform Investment in Infrastructure Operators: Invest alongside proven operators like Elevate who combine capital deployment with operational expertise. The Texas Permanent School Fund’s $200+ million commitment validates the institutional investment thesis. Platform investments offer diversification across multiple university relationships and operational expertise that individual deals cannot replicate.

Risk management focuses on political and regulatory factors rather than market risk. University missions provide defensive characteristics, but public institution oversight creates execution complexity. Success requires operators who understand both real estate development and university governance.

The 15-year hold period aligns with family office investment horizons while capturing both NIL-driven demand increases and metropolitan area real estate appreciation. This isn’t sports betting—it’s infrastructure investment disguised as collegiate athletics, offering patient capital the rare opportunity to combine social good with compelling returns.

Bottom line: Universities represent one of the largest pools of underutilized real estate in America, sitting on hundreds of billions in land value that traditional financing mechanisms cannot efficiently monetize.

The House settlement’s $20.5 million annual athlete compensation requirement creates immediate capital needs that infrastructure partnerships can address while unlocking long-term value for sophisticated investors who understand the utility-like characteristics hiding beneath the football fields.

And welcome back, college football.

⸻

Citations and Resources

House Settlement and College Athlete Compensation

-

$20.5 Million Annual Cap: ESPN, “Judge OK’s $2.8B settlement, paving way for colleges to pay athletes,” June 7, 2025

-

4% Annual Increase: Yahoo Sports, “NCAA’s House settlement approved, ushering in new era where schools can directly pay athletes,” June 7, 2025

-

22% of Average Athletic Department Revenue: CBS Sports, “How college athletes will be paid after House v. NCAA settlement,” June 7, 2025

-

$2.8 Billion Settlement: NPR, “With $2.7 billion settlement approved, college sports’ big money era is officially here,” June 7, 2025

University of Texas Moody Center

-

$338 Million Investment by Oak View Group: Texas Connect, “Moody Center will be new home for Longhorn basketball and major touring acts,” May 11, 2022

-

35-Year Agreement: Wikipedia, “Moody Center,” accessed August 29, 2025

-

60 Days University Control: Oak View Group press release, “Oak View Group Expands Team for Moody Center in Austin, TX,” February 22, 2021

Elevate Collegiate Investment Initiative

-

$500 Million Fund: Business Wire, “Elevate Launches Collegiate Investment Initiative to Support Growth of Athletic Programs,” June 9, 2025

-

Texas Permanent School Fund $60 Billion: Chief Investment Officer, “Texas Permanent School Fund, Velocity Back $500M Collegiate Sports Initiative,” June 9, 2025

-

Velocity Capital Partnership: Sportico, “Elevate Opens $500M College Sports Fund with Texas Endowment, Velocity,” June 10, 2025

-

Penn State and UCLA Denials: Sportico, “Penn State, UCLA Deny Deals With Elevate’s New College Sports Fund,” June 9, 2025

Arizona State Novus Innovation Corridor

-

350+ Acres and Economic Impact: AZ Big Media, “Here’s how Novus Innovation Corridor is projected to generate 34,000 jobs,” July 19, 2021

-

$1.86 Billion Economic Impact: ASU Economic Development, “Novus Innovation Corridor – Economic Development,” April 30, 2025

-

$4.6 Billion in Economic Output: ASU News, “ASU creating thriving live-work-play community in Novus project,” accessed August 29, 2025

College Athletic Facilities and Infrastructure

-

Stadium Construction Projects: Based on aggregated project announcements including: South Carolina Williams-Brice Stadium ($350M), Kansas Gateway District Phase 2 ($360M), Tennessee stadium upgrades ($337M), UCF Roth Tower ($88M), Memphis Simmons Bank Liberty Stadium ($226.5M), and other major projects. Sources: SC Daily Gazette, ESPN, Construction Dive, Fox13 Memphis, various project announcements.

-

University Utilization Rates and Ground Lease Models: Urban Land Magazine, “Arizona State University’s Novus Innovation Corridor Embodies a New Era in Phoenix,” February 13, 2024

Sports Business Data Referenced

-

Power Conference Revenue and Media Rights: Data cited from internal Momentous Sports research document “August 2025 Sports Investment Info” (provided document)

Additional Supporting Sources

-

LEED Certification and Sustainability: NAIOP, “Novus Innovation Corridor: A Model for Modern Cities,” Spring 2023

-

Public-Private Partnership Structure: Novus Innovation Corridor official website, “About Innovation Zones in Tempe,” December 9, 2024

Note on Data Verification

College Stadium Construction Spending Estimate: The “$3 billion in 2025” figure represents an estimate based on aggregated major project announcements rather than a verified industry statistic. Individual major projects identified include the specific projects listed above, but a comprehensive industry total was not available from public sources.

Municipal Bond Risk Profile Claims: The comparison of university infrastructure investments to municipal bonds represents analysis and opinion rather than empirically verified risk ratings from rating agencies.